Coffee, a globally treasured commodity, is not just a staple in our daily lives but also a significant player in the world market. Over 2.25 billion cups are savored daily, making its trade pivotal in the global economy. The pricing of coffee is intriguing, subject to various influencing factors, and hence, a hotspot for market speculation.

The world primarily trades in two types of coffee: Arabica and Robusta. Arabica, known for its superior flavor and quality, commands a higher price, distinguishing it as the more premium choice.

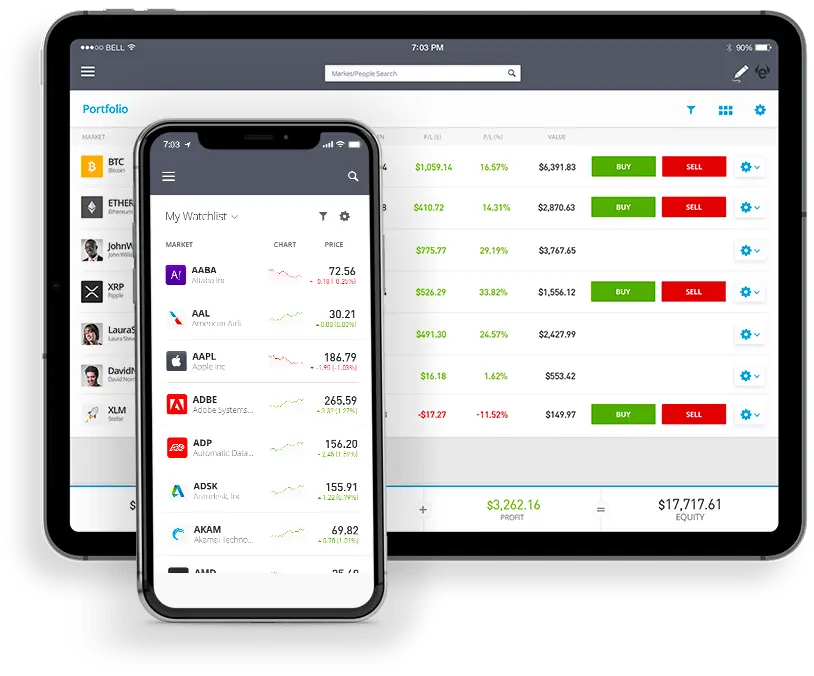

For those interested in market dynamics, trading Coffee Contracts for Difference (CFDs) offers an exciting opportunity to engage with this vibrant market. Through platforms like eToro, even agricultural commodities like coffee become accessible for trading. To navigate this intriguing world, my comprehensive guide provides detailed insights and personal experiences, ensuring a well-rounded understanding for anyone keen on investing in this fascinating commodity.

When trading Coffee Arabica on this online investment platform, it's crucial to understand that you're engaging in Contracts for Difference (CFDs), not purchasing or storing physical coffee beans. The allure of CFD trading lies in its flexibility – it allows speculation on market movements without the need for physical ownership, an aspect I find particularly advantageous.

My experience trading this commodity on this broker has revealed several key benefits:

Navigating to the Coffee Arabica Future asset page on the platform, you're greeted by the Overview section, a hub of essential features:

I personally liked these integrated tools that are capable of enhancing my commodity trading experience:

Here are the steps that I did to trade this asset on the platform:

That concludes our guide to trading this interesting commodity on eToro. Whether you're using the web platform or the mobile app, it's crucial to be fully aware of the risks involved in coffee trading. Factors such as market volatility, global demand, and geopolitical events can significantly impact your investments.

Remember to apply the tips and insights shared here wisely as you embark on your coffee trading journey. Staying informed and strategic will help you navigate the complexities of this exciting market.

A eToro é uma plataforma multi-ativos que oferece investimento em ações e criptoativos, bem como a negociação de CFDs.

Note que os CFD são instrumentos complexos e apresentam um elevado risco de perda rápida de dinheiro devido à alavancagem. 61% das contas de investidores de retalho perdem dinheiro ao negociar CFDs com este fornecedor. Deve considerar se compreende como funcionam os CFD e se pode suportar o elevado risco de perder o seu dinheiro.

Esta comunicação destina-se apenas a fins informativos e educacionais e não deve ser considerada como aconselhamento ou recomendação de investimento. O desempenho passado não é garantia de resultados futuros.

O Copy Trading não constitui aconselhamento de investimento. O valor dos seus investimentos pode subir ou descer. O seu capital está em risco.

Não invista a menos que esteja preparado para perder todo o dinheiro investido. Este é um investimento de alto risco e não deve esperar proteção caso algo corra mal. Reserve 2 minutos para saber mais.

Os investimentos em criptomoedas são arriscados e podem não ser adequados para investidores de retalho; pode perder todo o seu investimento. Perceba os riscos aqui: https://etoro.tw/3PI44nZ.

A eToro USA LLC não oferece CFDs e não se responsabiliza pela exatidão ou integridade do conteúdo desta publicação, que foi preparada pelo nosso parceiro utilizando informações públicas não específicas da eToro.

Sobre Nadav Zelver

Sobre Nadav Zelver